Sharia Products

Any Sukuk must be based on a Sharia approved structure and contract, for example Ijara, Salam, Istisna Murabaha, Musharaka, Mudaraba, Wakala. Conditions of the adopted contract must be fulfilled in the Sukuk.

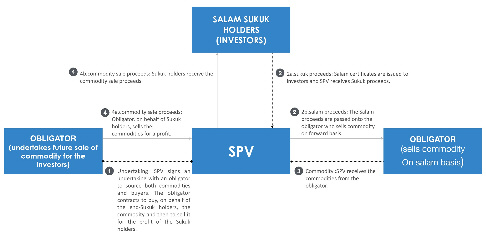

Sukuk Salam

The issuer of the certificates is a seller of the goods of Salam and the subscribers are the buyers of the goods, while the funds realized from subscription are the purchase price (Salam capital) of the goods.

Sukuk Mudaraba

The issuer of these certificates is the Mudareb, the subscribers are the owners of capital and the realized funds are the Mudaraba capital.

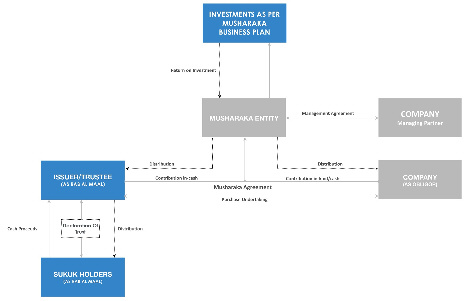

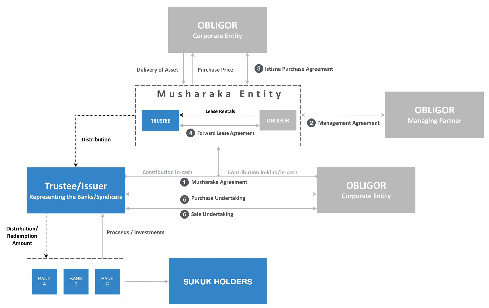

Sukuk Musharaka

The issuer of the certificates is the inviter to a partnership with him in a specific project or determined activity. The subscribers are the partners in the Musharaka contract.

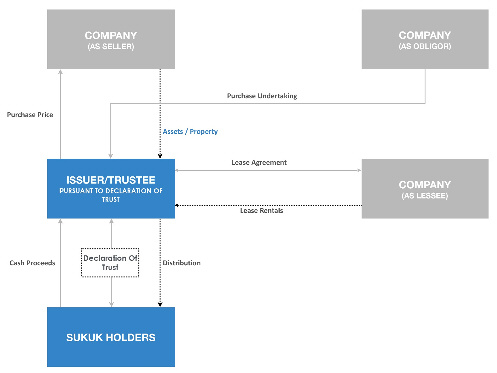

Sukuk of ownership of leased assets

Issuer of these certificates is seller of asset to be leased on promise and the subscribers are the buyers of the asset, while the funds mobilized through the subscription are the purchase price of the asset.

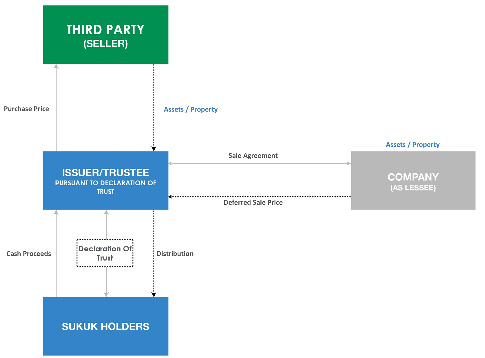

Sukuk Murabaha

The issuer of the certificates is the seller of the Murabaha commodity, the subscribers are the buyers of the that commodity and the realized funds are the purchasing cost of the commodity.

Sukuk Istisna

The issuer of these certificates is the manufacturer (supplier/seller) and the subscribers are the buyers of the intended product, while the funds realized from subscription are the cost of the product.

Lease Rentals in Ijarat Ain and Ijarat Fil Zimma

- First lease rent must be a known figure.

- It is then permissible that the rentals for subsequent periods be determined according to a certain benchmark.

- Such benchmark must be based on a clear formula which is not subject to dispute, because it becomes the determining factor for the rentals of the remaining periods.

- This benchmark should be subject to a ceiling, on both maximum and minimum levels.

- Lessor and lessee may agree to amend the rentals for the future periods (i.e. the periods for which the lessee has not yet received any benefit) by way of renewal of the Ijarah contract.

- The rentals of any previous periods which have not yet been paid become a debt owed to the lessor by the lessee, and therefore cannot be increased.

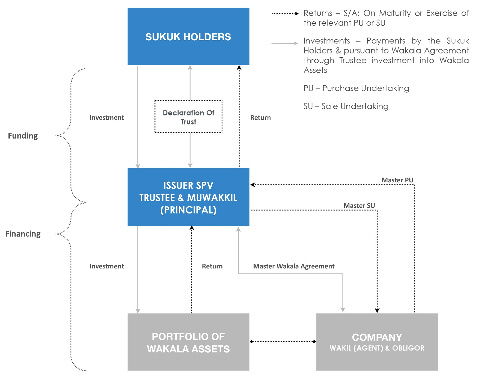

Sukuk for Investment Agency

The issuer of these certificates is the investment agent, the subscribers are the principals and the realized funds are the entrusted capital of the investment.

Sukuk of ownership of described usufruct to be made available in the future

The issuer of these certificate is the seller of usufruct of an asset to be made available in the future as per specification. The subscribers are buyers of the usufruct and the funds mobilized through subscription are the purchase price of the usufruct.

Sukuk of ownership of services

The issuer of these certificates is the seller of services and the subscribers are the buyers of the services, while the funds mobilized through subscription are the purchase price of the services.

Sukuk of ownership of the usufruct of existing assets

Issuer of these certificates is the seller of usufruct of an existing asset and the subscribers are buyers of such usufruct, while the funds mobilized through subscription are the purchase price of the usufruct.

The holder of long term lease can issue such Sukuk which must be redeemed before the expiry of the usufruct.

Promises in the eyes of Sharia

- Promise to sell

- Promise to buy

- Promise to give an asset on asset

- Promise to take an asset on lease

- The conditions for binding promises

- Compensation to the beneficiary for non fulfillment of profit by the Promisor

- Promises are not a way of gambling

Redemption for Sukuk

It is permissible for the issuer to redeem a Sukuk after the allotment and payment of the subscription amount, at the market price or at a price agreed upon between the parties at the time of subscription, on the condition that the subscription amount or the redemption proceeds are not deferred.

Securities for Sukuk

None of the beneficiaries viz. the Issuer, the Manager and the Participants cant be the guarantors for the subscribers to the Sukuk. For example, in Sukuk Musharaka, the Issuer and partners cannot be guarantors.

Securitization of Receivables

Securitization of Receivables is forbidden under Sharia as it tantamount to trading in debt.