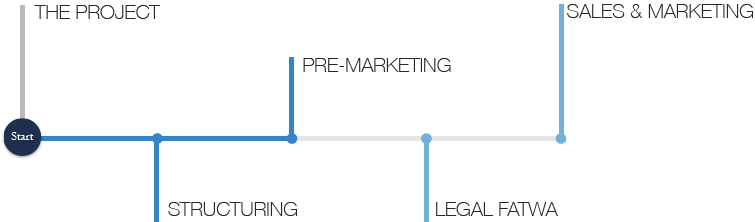

Implementation

The Steps needed to issue a Sukuk are as follows:

Understanding the project

a) Review the information provided.

b) Understand the needs and requirements of the client.

c) Discuss the project with client and if required, ask for relevant information.

d) Finalise the arrangement.

Structuring the project

a) Based on needs and requirements of the client, develop potential Sharia compliant structures / solutions.

b) Discuss these structures with client and finalise the structure.

c) Develop a draft term sheet based on the finalised structure and discuss it with the client.

Pre-marketing feedback

a) Based on the final structure and draft term sheet, identify certain potential investors and discuss the transaction with them on a no names basis.

b) Invite feedback from the identified potential investors (on the key aspect like structure, risk, collateral, return, investment period etc).

c) Discuss the feedback received with client.

d) If required make changes to the structure based on feedback received.

Transaction legal documents and Fatwa

a) Engage an external law firm to develop legal documents for the transaction.

b) Provide law firm with the requested assistance on the legal documentation of the Sharia aspects.

c) Once legal documents have been prepared, review these legal documents and provide Sharia feedback.

d) Discuss the Sharia feedback with the lawyers and client.

e) Once all the Sharia comments have been resolved, arrange a Fatwa to be issued by the sharia board (2 scholars) confirming the Sharia compliance of the structure and legal documents.

Sales & Marketing

a) Develop marketing material for the transaction.

b) Based on the type of transaction, develop a list of potential investors who are likely to look into this opportunity with interest.

c) Initiate contact with potential investors with regards to the transactions.

d) Organise road shows for the potential investors.

e) Depending upon the jurisdiction of potential investors, and if required, help the client in identifying the relevant partner which will provide regulatory cover for the transaction.

f) Based on commitments received, close the transaction.