About us

Our Mission

General Development Bank provides a unique combination of Sharia legal and financial structuring and placement services...

Islamic Finance

Sukuk

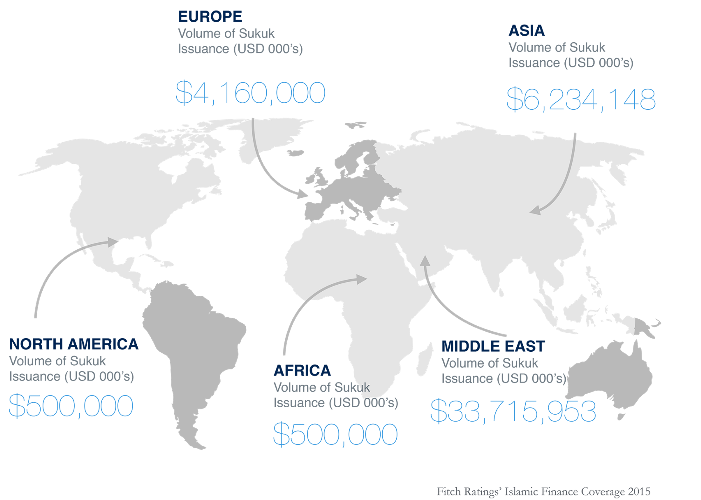

The emergence of Sukuk has been one of the most significant developments in Islamic capital markets in recent years...

Sharia Products

Sharia Products

Sukuk Salam

The issuer of the certificates is a seller of the goods of Salam and the subscribers are the buyers of the goods...

Islamic Finance News

The value of assets in the Islamic finance sector is expected to increase by 80 percent over the next five years, reaching $3.24 trillion in value by 2020, according to initial findings garnered from the upcoming State of the Global Islamic Economy (SGIE) report.

The report, which is commissioned and supported by Dubai Islamic Economy Development Centre in partnership with Thomson Reuters , and in collaboration with Dinar Standard, will be published ahead of the second Global Islamic Economy Summit (GIES), which is taking place in Dubai this October 2015.

Today, Islamic finance is used in 60 countries and is an ethical, stable and viable financial system that is growing faster than conventional finance. The biggest markets are in Southeast Asia and the Middle East.